One Big Bill, Many Big Consequences: House Passes Trump’s $4.5 Trillion Package, Leaving Millions Behind

In a tense 218–214 vote, the U.S. House of Representatives passed President Donald Trump’s sweeping tax-and-spending bill Thursday afternoon, completing its rapid and deeply controversial journey through Congress. With no Democratic support and multiple last-minute flips among Republican holdouts, the nearly 900-page bill heads to Trump’s desk — likely to be signed on July 4 with full media fanfare as a symbolic Independence Day win for Trump’s second-term agenda.

But beneath the pageantry lies a sobering reality. With deep cuts to Medicaid and food assistance, new burdens for disabled and working-class Americans, and a ballooning national deficit, the bill will reshape the economic landscape in ways that critics warn will disproportionately harm the country’s most vulnerable.

A Legislative Win at Human Cost

At the heart of the bill is a $4.5 trillion tax overhaul that extends and expands the Trump-era tax cuts, introduces temporary deductions for tipped workers and seniors, and raises the cap on state and local tax (SALT) deductions — though only for the next four years. These moves were framed by Republican leaders as a middle-class victory. Yet analysts from the Congressional Budget Office and several independent policy groups caution that the biggest beneficiaries are high earners and corporations.

To help offset the cost of these sweeping tax reductions, the bill enacts over $1.2 trillion in reduced funding and administrative changes to Medicaid and SNAP — including accelerated work requirements likely to force millions off coverage. Estimates suggest that as many as 11.8 million people could lose health coverage by 2034.

These impacts will not be felt equally. Rural communities reliant on small hospitals, tribal health services, and community clinics are expected to see immediate strain. Children, seniors, chronically ill patients, and low-income workers will face the most immediate consequences as programs they rely on are scaled back — or eliminated altogether.

The Final Push

While the bill’s passage in the Senate earlier this week had already signaled Republican momentum, the House vote was not guaranteed. With unanimous Democratic opposition and multiple Republican holdouts, House Speaker Mike Johnson and Trump’s inner circle spent the last 48 hours engaged in behind-the-scenes negotiations and public pressure campaigns.

Several last-minute policy adjustments helped turn the tide. Work requirements for Medicaid were accelerated to 2026—appeasing fiscal conservatives—while a controversial provision that would have eliminated SNAP benefits for certain households was struck from the bill entirely. Rural hospital funding was increased, and the SALT cap was temporarily lifted to win over suburban and moderate Republicans.

Behind the scenes, President Trump reportedly called lawmakers directly, warning of electoral consequences for any dissent. Speaker Johnson, for his part, emphasized the need to deliver a “landmark policy victory” before Independence Day.

A Speech for the History Books

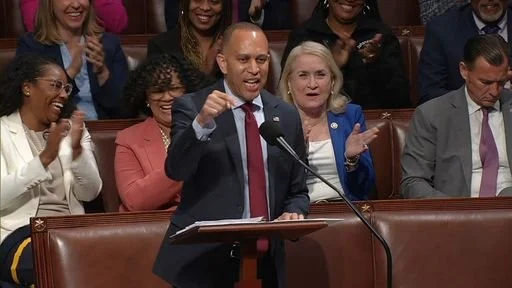

Hakeem Jeffries delivering his

8 hour and 44 minute filibuster on July 3, 2025

As the vote approached, House Democratic Leader Hakeem Jeffries took to the floor in a historic act of resistance against what he considered to be a “reverse Robin Hood”. Stealing from the poor to benefit the wealthy.

Speaking for eight hours and forty-four minutes, Jeffries set a new modern record, using the time to read letters from constituents, share stories of families at risk of losing coverage, and denounce the legislation as, “Unconscionable. Un-American. One big ugly bill.”

Rep. Alexandria Ocasio-Cortez condemned the tip deduction provision as a distraction, calling it “a scam,” while progressive lawmakers highlighted how the bill prioritizes wealth over wellbeing. Meanwhile, tension simmered even within Republican ranks. Rep. Marjorie Taylor Greene called the vote “a s***show,” and Rep. Thomas Massie ultimately broke with the party, citing deficit concerns.

Who Gets Left Behind?

The hidden impacts of Trump’s “Big Beautiful Bill” is deep within our fellow Invisible Communities.

One of the most far-reaching changes in the bill is not an outright funding cut, but the acceleration of Medicaid work requirements, moving their rollout to 2026 instead of the originally proposed 2029.

Under these new rules, so-called “able-bodied adults” must document at least 20 hours per week of work, job training, or qualifying community engagement to remain eligible for Medicaid coverage. Some have even suggested that people simply “find jobs with insurance,” ignoring the reality that many employers deliberately limit workers' hours to avoid offering benefits. On the surface, these requirements may sound reasonable — but for millions of Americans living with invisible disabilities, chronic illnesses, or caregiving burdens, they represent a quiet bureaucratic cliff.

For example, a person living with endometriosis, long COVID, or bipolar disorder may not meet the legal threshold for federal disability benefits but still experience unpredictable, debilitating health episodes. These are the people who often fall through the cracks. They are not “lazy,” not unwilling, but unseen by systems that weren’t designed to recognize fluctuating, non-visible, yet very real disabilities.

Without formal documentation, these individuals may be classified as "able-bodied" under the new rules. They would be required to either maintain consistent employment or enter job training programs — both of which can be physically or mentally unsustainable, and which often fail to account for needed accommodations. Those who can’t comply or who miss reporting deadlines due to hospitalization, burnout, or caregiving crises could face “lockout periods” — temporary bans from reapplying for Medicaid that could last months.

For many, that gap in coverage isn’t just inconvenient. It could mean:

Losing access to life-saving prescriptions

Being forced to delay surgery or pain management treatment

Paying out of pocket for ER visits or mental health crises

Falling into deeper poverty or even homelessness

The emotional and financial trauma of that kind of policy failure isn’t a side effect, it’s the system working as designed for cost containment.

And while defenders of the bill argue it will “encourage work,” there’s little evidence that punitive reporting regimes actually increase employment. What they do increase is paperwork, confusion, and hardship.

In the end, it’s the people already fighting hardest to stay afloat — those with unrecognized disabilities, caregivers, survivors of chronic illness — who are most likely to be pushed out of the safety net. The new rules criminalize this gray area. These individuals could lose care not for failing to work, but for failing to prove they can’t. An impossible burden for many.

A couple sits together, looking discouraged, while looking at a table full of what is assumed to be medical bills.

They may now lose coverage simply because their illness doesn’t fit the system’s narrow categories. If they miss deadlines or experience health flare-ups, they could be locked out of Medicaid for months without access to prescriptions, treatment, or even emergency care. This isn’t a cut on paper. It’s a collapse in practice.

Children in Intergenerational Poverty

SNAP and Medicaid reductions don't just impact adults, they destabilize entire family systems. Parents struggling to meet work requirements may lose benefits, forcing trade-offs between rent, food, and medicine. The long-term effects for children — ranging from malnutrition to untreated asthma — will echo for years.

These kids didn’t vote for this bill. But they may suffer its most enduring consequences.

A little boy is facing away from the camera, looking into an open fridge that is empty.

Service Workers and the Tip Deduction Illusion

Trump has promoted a tax deduction for tip income as a major win for working-class Americans. But the deduction is temporary, capped at $25,000, and only applies to those who itemize taxes — typically higher earners. Most waitresses, rideshare drivers, or part-time bartenders won’t benefit.

Meanwhile, they may lose SNAP or Medicaid, even if their real earnings are below poverty level. It’s a political sleight of hand, promising financial relief while taking away lifelines.

A food server resting her head on her hand, against a wall while standing. She seems tired and overworked.

Seniors on Fixed Incomes

Though the bill includes deductions for seniors, it also narrows funding for long-term care and leaves Medicare untouched — despite inflation and rising drug costs. Elderly Americans who rely on Medicaid for assisted living or in-home care may find themselves priced out or forced into institutional settings. Caregivers will face added stress, and senior poverty — already on the rise — may worsen further.

Community Health Clinics & Nonprofit Care Networks

Many clinics serving low-income, LGBTQ+, BIPOC, or disabled communities rely on Medicaid reimbursements and public health grants. With new funding restrictions and uncertainty, these frontline programs may be forced to close or cut staff.

When the doors shut, it won’t be the insured who suffer first. It will be the chronically ill, the unhoused, the undocumented, and those without a voice in Washington.

What Happens Now?

President Trump is expected to sign the bill on July 4, framing it as a major campaign milestone. But for the communities impacted by its fine print, July 4 won’t feel like the grand independence we flash. It may feel more like abandonment for our fellow Americans’

Civil rights and public health organizations are already preparing legal challenges. Several governors are exploring ways to protect state-run Medicaid programs. And in the lead-up to the 2026 midterms, the human cost of this legislation will almost certainly become a defining issue.

The Invisible Voice Take

Trump’s “One Big Beautiful Bill” is a victory in headlines and a disaster in households. It rewards the wealthy while punishing those living in systemic precarity. For families already navigating chronic illness, intergenerational poverty, or invisible disabilities this represents not reform, but relapse.

At The Invisible Voice, we believe policy should be measured not by political wins, but by lived impact.

The fight for visibility doesn’t end at a signing ceremony — it’s everyday reality for over 40% of Americans living with chronic health conditions.

Of those, nearly 96% live with health conditions invisible to the “normal” eye — and to bureaucracy.

This is not a niche. This is nearly half the nation.

We’re not just watching this unfold — we’re living it.

Our own Invisible Voice columnists are part of that 40% the headlines forget.

So as policies shift and consequences set in, we’ll be here — reporting from the inside out.