Tariffs, Venmo, and Crypto Dreams: America’s Economy Is Starting to Feel Like a Meme

By Chelsea BreeAnn Hardesty

Welcome to 2025, where economic policy feels more like a performance than a plan. President Donald Trump is promising rebate checks funded by tariffs. The U.S. Treasury now accepts Venmo and PayPal donations to “help pay off the national debt.” And in some corners of the internet, Trump-themed coins and crypto tax schemes are being tossed around like serious policy ideas.

It’s flashy, it’s surreal. But for everyday Americans trying to pay rent or cover medical bills, it’s starting to feel like a bad joke.

Trump’s Tariff Rebates

Trump’s latest pitch is simple: the U.S. is “making so much money on tariffs” that it can afford to send rebate checks to certain income groups.

“We have so much money coming in from tariffs… we’re thinking about a little rebate,” Trump told reporters in July. “But the big thing we want to do is pay down debt.”

The math? Still missing. No eligibility details. No legislative plan. Just a big promise. But now, that promise has become a formal policy proposal, and it’s hitting mainstream headlines.

On July 28, Senator Josh Hawley (R‑Mo.) formally introduced the American Worker Rebate Act, echoing Trump’s recent talking points and turning them into a bill.

The proposal would send:

$600 checks per adult and dependent child, with income-based phase-outs

Larger rebates if 2025 tariff revenues exceed projections

All funded directly from tariff collections estimated at over $30 billion in June alone, with $150+ billion expected this year. (Source: NBC News,Forbes)

This isn’t just a semantics issue, it’s like a confession wrapped in legislation.

A rebate means you already paid into something. It’s a partial refund. So if tariff money is being rebated to Americans, that means we paid the tariffs to begin with. If, say China, were really footing the bill, there would be nothing to rebate.

What Trump and now Hawley are doing is taking tariff revenue collected from American companies (which was then passed to consumers via price hikes), and repackaging it as a political giveaway.

It’s not a stimulus either. It’s a refund on a quiet, regressive tax.

If the tariff conversation leaves you feeling lost, you’re not alone, and that’s by design. Political messaging has sold the idea that tariffs are a way to “make other countries pay us.” But the truth is far less patriotic and far more expensive for American households.

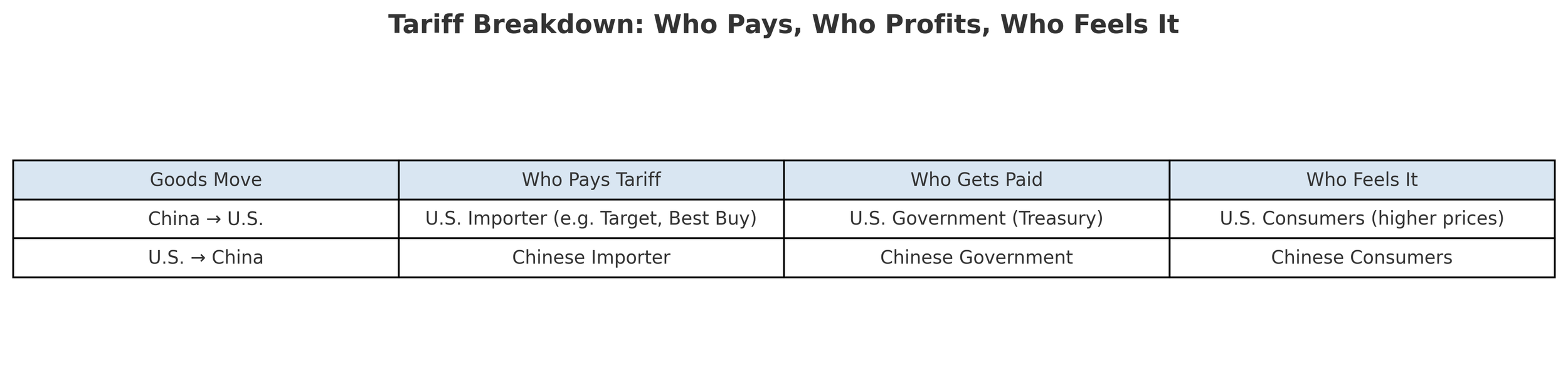

Let’s break it down.

A Two-Step Payment Process

When a U.S. company orders goods from overseas, they go through two separate financial hits:

First Payment – They pay the foreign supplier for the goods.

Example: 1,000 chairs at $50 = $50,000 paid to a Chinese manufacturer.Second Payment – When those goods arrive at a U.S. port, the company must pay a tariff to the U.S. government.

If the tariff is 25%, that’s $12,500 paid to U.S. Customs.

The total cost becomes $62,500. To recoup it, the importer raises prices. Then retailers raise prices again and consumers end up covering the difference.

Meanwhile, foreign exporters may also raise prices due to retaliatory tariffs or supply costs. So prices increase on both sides, and the burden falls on the people, not the politicians.

“Trump made China pay us” — Not really.

U.S. importers paid the tariffs. That money went to the U.S. Treasury. Then it’s being passed back to Americans. Not as a gift, but as a partial refund on something they already paid for. But what about when we export goods to them?

Other countries charge their own tariffs on incoming U.S. goods. China, for example, retaliated with tariffs on soybeans, cars, and more. Hurting U.S. farmers and manufacturers.

Each country keeps the tariff money collected at its border. No country pays another’s government directly.

“They’re paying us billions!” is a better soundbite than “We taxed ourselves to feel strong.”

Foreign exporters may adjust their pricing a bit, but economists widely agree that American consumers and companies carry nearly 100% of the cost.

What’s really happening is that we’re taxing ourselves, then turning around and calling it a win.

The U.S. Treasury on Venmo, While Americans Crowdfund Their Own Survival

If that wasn’t strange enough, the Treasury Department has quietly made it easier for citizens to donate to the federal government through Venmo and PayPal.

This isn’t new, the “Gifts to Reduce the Public Debt” program has existed since 1961. But until now, donations were mostly mailed-in checks. Digital payment options were added to “modernize accessibility.”

The results are almost comedic:

2023: About $1 million in donations

2024: $2.7 million, still less than a single hour of interest payments on the national debt

Mid-2025: Roughly $434,000 collected so far, equal to three minutes of debt interest

But the bitter irony is that millions of Americans are already forced to crowdfund their own basic healthcare.

Nearly 1 in 3 Americans has turned to platforms like GoFundMe to fund surgeries or treatments, often falling short. Meanwhile, insurance giants pocket record profits.

And now, those same people are being asked to Venmo the Treasury to cover a debt that was supposed to fund services they still don’t have.

While Americans debate rebate checks and symbolic solutions, such as even crypto currency, the numbers aren’t slowing down:

National debt: $36.7 trillion (as of July)

Interest payments: Over $1 trillion annually

Projected debt: 138% of GDP by 2046 (per CBO)

“We’re nearing a place where the illusion of solvency depends on confidence alone. And confidence is easier to lose than it is to regain.”

Crypto Creeps into Conversations

Adding another strange twist: the rise of Trump-themed cryptocurrencies and collectible coins, some of which are marketed to supporters as investments or patriotic keepsakes. While unofficial, these tokens reflect a broader cultural shift where financial products are doubling as political branding.

Meanwhile, a number of U.S. states have started exploring how blockchain technology or cryptocurrency might be integrated into public systems. Some are experimenting with digital IDs or licenses. Others have floated the idea of allowing tax payments in crypto or even using crypto to help pay down state debt.

In the U.K., the Reform Party has already begun accepting Bitcoin donations, with party leaders suggesting citizens should be able to pay taxes in cryptocurrency. Some voices in the U.S. have echoed these ideas, especially among libertarian-leaning groups online. A viral post even claimed Trump would use crypto to help pay off the national debt.

But that’s not something the federal government can actually do, at least not under current law. U.S. sovereign debt must be paid in U.S. dollars. And crypto’s volatility makes it risky for large-scale budgeting or debt service.

Critics say moves like this invite confusion, scams, and instability in the name of “innovation.” Supporters argue it's a sign that the old methods, like paper checks, slow banking, and snail-mail tax returns, are falling behind the digital age.

Symbolism Over Solutions

Rebate checks feel good. Venmo donations feel participatory. Crypto sounds innovative. But none of it fixes the structural problems.

Americans plead for help on GoFundMe for affordable healthcare, and the richest country in the world has started passing the virtual hat for its own bills and issuing rebates.

For working parents, disabled folks, veterans, gig workers who make up well over half the country itself, it’s hard not to see this as political theater. The stage lights are bright and blinding. The headlines and hashtags may be catchy. But the tab keeps growing, and the audience is getting tired of the show.